Beyond carbon: The business case for holistic action

The latest research by Accelar into the sustainability commitments of FTSE350 companies has been published by SustMeme this week. In a guest blog which is shared below, Clare Ollerenshaw sets out the need for businesses to look beyond carbon in order to take meaningful action to meet environmental and climate targets.

We are grateful to SustMeme for publishing these insights from our research and you can view the original article and explore the latest other corporate sustainability and innovation content

here. To find out more about how Accelar is supporting businesses to accelerate the green transition, grow their business sustainably and engage with high integrity UK offset markets, check out

our services page or contact

Clare Ollerenshaw.

The 2023 synthesis report from the Intergovernmental Panel on Climate Change (IPCC) was underpinned by a pivotal message: this decade represents humanity’s last opportunity to take action to limit global warming to 1.5 degrees. Whilst a large portion of this responsibility undoubtedly falls on global leaders and governments, large businesses and corporations, in collaboration with their supply chains, also have a critical role to play. So, how well are they rising to the challenge?

More commitments made public

Well, in recent years, an increasing number of businesses have been publicly pledging their commitment to environmental sustainability. They have been making some of the right noises. This trend has been driven by a combination of factors, including tighter environmental regulations, growing customer demand for less environmentally impactful products and services, and a genuine desire amongst companies to reduce their carbon footprint and contribute to a more sustainable future. However, when we take a closer look at those commitments, the focus soon starts to narrow.

Narrow focus in the FTSE 350

Accelar carried out data analysis to explore these trends in more detail, looking at businesses on the FTSE 350 Index, which comprises the 350 largest companies listed on the London Stock Exchange. Accelar reviewed the websites of 88 FTSE 350 businesses, analysing publicly stated organisational commitments to managing carbon, working with nature, managing resources and climate resilience.

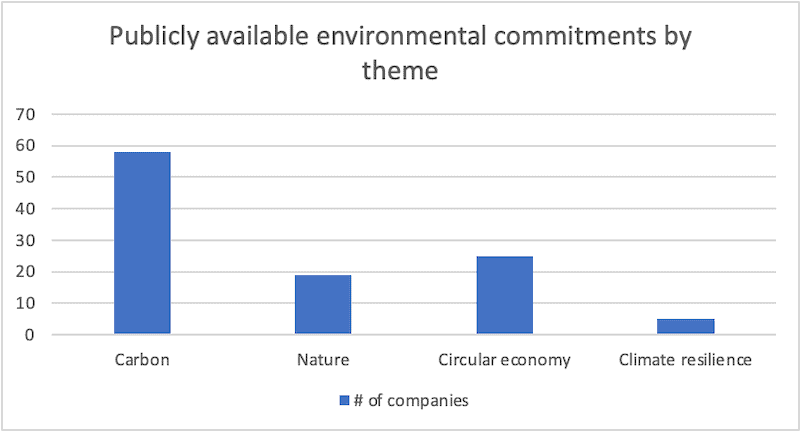

Of the 88 businesses put under the microscope, our analysis discovered:

- 58 have made public their carbon commitments;

- 19 have made public their nature commitments;

- 25 have made public their resource, materials and circular economy commitments; and

- 5 have made public their climate resilience commitments.

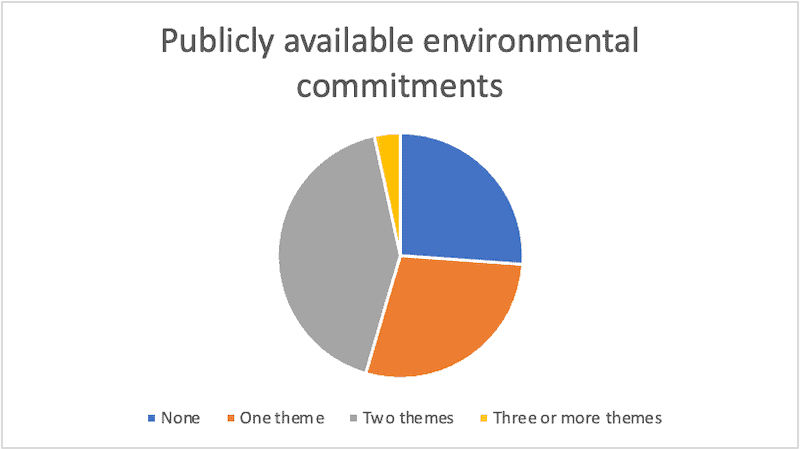

In terms of the thematic mix of commitments made, our study of the 88 also revealed:

- 25 have made a public commitment on 1 theme;

- 37 have made public commitments on 2 themes;

- 3 have made public commitments on 3 themes, or more; but

- 23 have made no public commitments, at all.

Risk of ‘Carbon Tunnel Vision’

It was no surprise that the most popular theme proved to be carbon, with 58 of the 88 companies making a public commitment. Especially at a time of spiralling energy costs and a gas crisis in Europe, carbon reduction is undoubtedly one of the biggest challenges for business, today. However, for that same reason, it is all too easy for carbon to become the sole focus of a company’s environmental action plan. This can result in what is known as ‘Carbon Tunnel Vision’.

Carbon Tunnel Vision is where a narrow focus on carbon reduction is pursued almost exclusively, often at the expense of other important areas like circular economy, biodiversity, and climate resilience. There is even a risk of unintended consequences arising out of this unhealthy obsession with carbon. So, in order to achieve effective and urgent climate action, organisations will need to look further than just carbon reduction and embrace a more holistic approach to net zero. By prioritising a broad range of sustainability areas, businesses can achieve effective and urgent climate action while also contributing to carbon reductions. Broadening the scope of commitments to incorporate other key focus areas such as circular economy and biodiversity can bring wider co-benefits for business, over and above just carbon reduction.

As regards biodiversity, our research found that 21% of businesses have made a commitment, which might arguably be seen as a relatively encouraging sign. In the UK, for example, this may increase further as government mandates for minimum Biodiversity Net Gain (BNG) come into place, helping to boost the topic’s profile within the built environment sector.

Much less positive was the data around climate resilience, with only 5 businesses out of 88 having made public commitments on what is now a key issue for business. Climate resilience strategies are not only important in terms of both policy and investors, but practically, as well. By setting resilience targets, companies can proactively identify and address potential risks to their operations and ensure continuity, plus stay ahead of regulatory requirements. This area is set to become business-critical for most organisations within the next five years, which is why a more holistic approach to environmental commitments is not just desirable, but essential.